By Olly Buston

Perhaps the greatest accolade Future Advocacy has ever received in our 7 year history was when team member Matt Fenech was awarded ‘Geek of the Week’ by ITV’s ‘Peston’ show for our work predicting how AI-fuelled automation would hit jobs across the UK, At the time we didn’t give much thought to whether the machines were coming for our own jobs. But does the high profile launch of new AI tools such as ChatGPT mean we were remiss in assuming campaigners and lobbyists were safe from automation?

Machine writing

Much of our jobs involve writing. Writing a campaign strategy. Developing messages for different audiences. Writing a briefing for a meeting. Writing an article for a newspaper. Writing a script for a campaign film. So just how good at these tasks are the new tools?

I tested out ChatGPT on some of these things, using an imaginary campaign calling for a new tax on cakes and confectionery as a case study. Here’s how it did (the full transcript of our interaction can be found at the end of this blog).

Writing a campaign strategy (ChatGPT rating 6/10)

I was initially blown away by the 7 point plan ChatGPT produced when I asked it to “write a strategy to persuade the UK government to adopt a tax on cakes and confectionaries”. And I could strengthen the strategy with additional prompts, for example by asking for a greater focus on persuading backbench conservative MPs, or a greater focus on Red Wall seats.

But on further reflection there was nothing new or innovative that someone with some experience in the field would not have thought of. This is not surprising because ChatGPT has been trained on historic data of things that have been written about in the past. The strategy would be a great straw man to kick off a strategy-development brainstorm however.

ChatGPT also did a good job of coming up with a list of the key types of stakeholders for the campaign, and I could prompt it further to give more details about priority political posts and officials. However the cut-off point for the training data from which ChatGPT learned is 2021, so ChatGPT was not able to provide information about who the key individuals are today.

Developing messaging for different audiences (ChatGPT rating 7/10)

When asked what messages would help persuade a right-wing Conservative MP to support the introduction of a new tax on cakes and confectionaries, ChatGPT’s answer was pretty impressive. It summarised that “By highlighting the economic benefits, the health benefits, the positive impact of the existing sugary drinks industry levy, presenting the tax as a market-based solution, addressing concerns about the potential regressive nature of the tax, emphasising the importance of personal responsibility, showing the positive impact on the Red Wall seats and appealing to the party’s principles, you can increase the chances of persuading a right-wing Conservative MP to support the introduction of a new tax on cakes and confectionaries.”

Arguably the toughest nut to crack for this campaign would be addressing the potential regressive nature of the tax. So I asked ChatGPT for help with that. This is what it came up with:

- Offering exemptions or credits for low-income individuals or households, to mitigate the impact of the tax on those who are most financially vulnerable.

- Highlighting the potential public health benefits of the tax, and emphasising that it could disproportionately benefit those who are most at risk of diet-related illnesses, many of whom are low-income.

- Using the revenue generated by the tax to fund programs that benefit low-income individuals and households, such as food assistance or healthcare.

- Comparing the tax to other regressive taxes, such as sales taxes, and arguing that the benefits of the cake and confectionery tax outweigh the potential regressive impacts.

But then ChatGPT gave me the wise counsel that “even with these arguments, the MP may still not support the tax.”

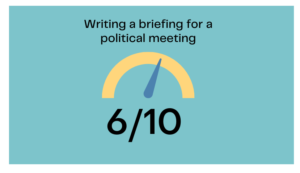

Writing a briefing for a political meeting (ChatGPT rating 6/10)

When asked to write a briefing for a meeting to persuade Rishi Sunak to support the tax we immediately hit a snag as the cut off point for all ChatGPT’s knowledge was 2021, when Rishi was Chancellor.

That said, ChatGPT did come up with some solid arguments. A weakness is that ChatGPT doesn’t prioritise very well between the statements it puts forward. This is reinforced by the fact that it does not give references which would add greater credibility to its work. An AI academic research assistant like Elicit could be used in tandem to overcome this weakness.

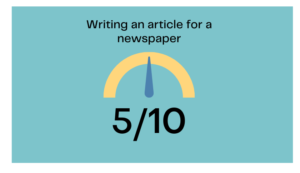

Writing an article for a newspaper (ChatGPT rating 5/10)

My attempt to get ChatGPT to write an article in the style of chef Nigella Lawson for the Telegraph, supporting the introduction of a tax on cakes and confectionery, fell a bit flat. It was clunky and didn’t really sound like Nigella apart from a few clichés. Nick Cave would surely agree, having said of a song written by ChatGPT in the style of Nick Cave that “It sucks”.

I think mimicking a particular individual’s words is some way off, other than in a slightly ham-fisted way. More generally it seems ChatGPT lacks a bit of flair when it comes to writing in a compelling and creative voice. There is a sense that it reproduces the average and everyday, rather than creating the exceptional and innovative.

Writing a script for a campaign film (ChatGPT rating 4/10)

Public health campaigners have for years been trying to reframe the debate about healthy food away from negative images and shock tactics. ChatGPT clearly didn’t get the memo and steamed straight in with clichés and fat-shaming tropes. I’m sure this could be ironed out by clever prompts. But I struggled to get it right and by this stage I wanted to escape back to the real world.

The verdict – should we believe the hype?

ChatGPT and similar tools are not going to lead to mass redundancies of campaigners and lobbyists any time soon. There remain many tasks that humans are better at, at the creative and innovative end of the spectrum. And the fact that ChatGPT’s training data only goes up to 2021 hinders its usefulness at a time when a week sometimes feels like a lifetime in politics. We’ve had two new prime ministers and three new chancellors since then.

Have no doubt that this is a powerful tool, however. ChatGPT can be helpful with more routine tasks and in writing first drafts and creating straw men to riff off. It might not help you with the next thing, the new thing, the creative thing. But it will help you get up to speed at lightning speed with ideas that are already out there. Clearly there are lots of uses in training.

In the immediate term campaigners and advocates who are able to harness the power of these tools to full effect will have an edge on their peers. Prompting AI tools like these to get the most useful response will become a valued skill. It’s worth remembering that although computers have been better at chess than humans ever since Big Blue v Kasparov in 1997, teams combining humans and computers remained superior for many years.

In the longer term, the gap between machine and human capabilities will inevitably narrow as computing power increases, programming challenges are overcome, and training data sets grow. One obvious and probably inevitable development will be a tool like ChatGPT that is trained on data in near real-time. This will make it massively more powerful and perhaps also more erratic and risky.

One of the great insights into the impact of technological change was made by Stanford University computer scientist Roy Amara. Some time in the 60s (or maybe 70s) he said that we tend to overestimate the impact of a new technology in the short run, but we underestimate it in the long run. There are countless examples where this seems to be the case. It makes sense if you imagine yourself walking up an exponential curve of change. The path doesn’t feel too steep initially. But after a while you realise you have climbed a mountain. That’s compound interest for you.

So I suspect after the initial hype about ChatGPT, articles will appear from savvy cynics crowing that not much has changed. And then shortly after that we will realise that everything has changed. There will be significant ethical implications of this… but that’s another blog.

================

Annex: ChatGPT SCRIPT (this is a recreation of the original conversation and is not identical to the first iteration)

Write a strategy do persuade the UK government to adopt a tax on cakes and confectionaries

- Build a strong case: Research the potential health and economic benefits of implementing a tax on cakes and confectionaries, such as reducing obesity and healthcare costs.

- Appeal to public sentiment: Highlight how a tax on unhealthy foods could improve the health and well-being of citizens and reduce the burden on the NHS.

- Use a phased approach: Suggest introducing the tax gradually to give businesses and consumers time to adjust, and to monitor its effectiveness.

- Offer alternative options: Propose using the revenue generated from the tax to fund public health initiatives, such as nutrition education programs and physical activity initiatives.

- Create a coalition: Gather support from public health organisations, medical professionals, and other stakeholders to demonstrate broad-based support for the policy.

- Communicate effectively: Use clear, concise language to explain the proposed tax and its potential benefits to the public and government officials.

- Be prepared to negotiate: Be open to discussing and modifying the proposal as needed to gain support from key stakeholders and legislators.

Add more on persuading backbench right wing conservative MPs

- Emphasise fiscal responsibility: Highlight how the revenue generated from the tax could be used to fund important public services and reduce the burden on taxpayers.

- Use market-based solutions: Frame the tax as a market-based solution that encourages individuals to make healthier choices while still respecting personal freedom.

- Highlight international precedents: Point to other countries that have implemented similar taxes and the positive results they have seen in terms of improved public health and reduced healthcare costs.

- Address concerns about business impact: Address concerns about the potential impact on small businesses by suggesting measures to mitigate the effects, such as providing tax credits or other forms of financial assistance.

- Emphasise limited government: Position the tax as a limited government intervention that allows individuals to make their own choices while still promoting public health and fiscal responsibility.

- Communicate with them: Build a relationship with backbench MPs, understand their concerns and tailor your message to address them.

- Create a sense of urgency: Highlight the immediate need to address the obesity epidemic and the long-term financial costs of not taking action.

Tailor the strategy to Red Wall MPs

- Highlight local impact: Tailor the message to the specific region and highlight how the tax could have a positive impact on the local community in terms of improved public health and reduced healthcare costs.

- Emphasise fairness: Position the tax as a fair way to address the problem of obesity and related health issues, which disproportionately affect lower-income individuals and communities.

- Use relatable examples: Use examples and anecdotes from the local area to illustrate the problem and the potential benefits of the tax.

- Address concerns about cost of living: Address concerns about the potential impact on cost of living by highlighting how the revenue generated from the tax could be used to fund important public services and programs that benefit the local community.

- Emphasise job creation: Highlight how the tax could lead to the creation of new jobs in the public health and wellness sectors.

- Emphasise community values: Position the tax as a way to promote community values such as responsibility, fairness and care for the vulnerable.

- Communicate with them: Build a relationship with Red Wall MPs, understand their concerns and tailor your message to address them.

Write a list of key stakeholders a for strategy to persuade the UK government to adopt a tax on cakes and confectionaries

- Public health organisations: Groups such as the British Medical Association and the Royal College of Physicians could provide valuable support and expertise in building a case for the tax.

- Medical professionals: Individual doctors, nurses, and other healthcare workers could add credibility to the campaign and help to build public support.

- Consumer advocacy groups: Groups such as Which? and the Consumer Association could help to build public support for the tax and raise awareness of the issue.

- Business organisations: Trade associations representing small businesses and the food industry could provide valuable input on the potential impact of the tax and suggest ways to mitigate any negative effects.

- Public officials: Local and national government officials, including MPs, could play a key role in shaping the debate and ultimately deciding whether to implement the tax.

- Health-related NGOs : Groups such as Cancer research UK and British heart foundation can provide statistics and research on the negative effects of high sugar intake on health and support the tax

- Dietitians and nutritionists: These professionals can provide expert advice on the potential health benefits of the tax and how it could be implemented effectively.

- Economists: Economists can provide valuable insights on the potential economic impact of the tax, including how it might affect public finances and consumer spending.

- Community leaders: Community leaders such as faith leaders, school heads, and youth leaders can help to build support for the tax among local communities.

- Media: The media plays an important role in shaping public opinion and can be used to raise awareness of the issue and build support for the tax.

Which politicians would be most important for this strategy?

- Government ministers: Ministers with responsibility for public health, finance and Treasury would be key decision makers and influencers in the adoption of the tax.

- Members of Parliament: MPs, particularly those on the Treasury Select Committee, would be important in shaping the debate and building support for the tax within the government.

- Opposition leaders: Leaders of opposition parties and their finance spokespersons would be important in shaping the debate and building support for the tax among the opposition.

- Local politicians: Local councillors and Mayors would be important in building support for the tax among the public and in their own communities.

- Backbench MPs: Backbench MPs, particularly those from the Red Wall regions and right-wing conservative MPs would be important in building support for the tax and addressing any concerns they may have.

- Special advisers and civil servants: Special advisers and civil servants working in the relevant government departments would have a significant role in shaping the policy and providing expertise.

- Party leaders: Party leaders would have a key role in the adoption of the tax, as they would have to decide on the party’s stance on the policy and whether to support it.

It’s important to note that different politicians have different priorities and may have different views on this policy, so it’s important to tailor your message to address their specific concerns and to build a relationship with them.

Who would be the one most important politician?

It would be difficult to identify one specific politician as the most important in this strategy, as the adoption of a tax on cakes and confectionaries would likely involve a range of politicians and government officials at different levels. However, the Chancellor of the Exchequer, who is the head of the UK Treasury and responsible for the government’s economic and financial policy, would likely play a central role in deciding whether to implement the tax, and would be one of the most important politicians to engage with in this strategy. Additionally, the Secretary of State for Health and Social Care, who is responsible for the National Health Service and public health, would also be a crucial stakeholder as the tax proposal is related to public health and the NHS.

Who are the key officials and advisors for this strategy?

- Treasury officials: Officials working in the Treasury department would be responsible for assessing the economic and financial implications of the tax and would play a key role in deciding whether to implement it.

- Department of Health officials: Officials working in the Department of Health would be responsible for assessing the potential impact of the tax on public health and would provide expertise on the issue.

- Special advisors to the Chancellor: Special advisors to the Chancellor of the Exchequer would play a key role in shaping the government’s economic and financial policy and would likely have a significant influence on the decision to implement the tax.

- Civil servants working in the relevant government departments: Civil servants working in the Treasury, Department of Health and Department for Environment, Food and Rural Affairs would provide expertise and support in the development of the policy.

- The Joint Health Unit: Joint Health Unit is responsible for advising the government on public health issues, they would play a key role in providing research and statistics about the negative effects of high sugar intake on health.

- The Office for Budget Responsibility: This independent body provides economic and fiscal forecasts and analysis which could be used to assess the potential impact of the tax on public finances and the economy.

- The National Institute for Health and Care Excellence (NICE): NICE provides guidance and advice to improve health and social care, they could provide guidance on how to implement the tax effectively and provide evidence-based research on its potential impact.

It’s worth noting that the officials and advisors may change over time and the government’s priorities might also change, so it’s important to stay updated on who is in charge of the relevant government departments and who the key advisors are.

Who is the current chancellor of the exchequer?

As of my knowledge cutoff in September 2021, the Chancellor of the Exchequer of the United Kingdom is Rishi Sunak. He has been in office since February 2020 and is a member of the Conservative Party. He is also the Member of Parliament for Richmond (Yorks). He was appointed Chancellor by Prime Minister Boris Johnson as part of a cabinet reshuffle. Sunak is responsible for the UK’s economic and financial policy, and as Chancellor he presents the annual budget to Parliament and oversees the Treasury.

What messages would help persuade a right wing Conservative MP to support the introduction of a new tax on cakes and confectionaries?

- Fiscal responsibility: Highlighting how the revenue generated from the tax could be used to fund important public services and reduce the burden on taxpayers.

- Market-based solutions: Framing the tax as a market-based solution that encourages individuals to make healthier choices while still respecting personal freedom.

- International precedents: Pointing to other countries that have implemented similar taxes and the positive results they have seen in terms of improved public health and reduced healthcare costs.

- Addressing concerns about business impact: Addressing concerns about the potential impact on small businesses by suggesting measures to mitigate the effects, such as providing tax credits or other forms of financial assistance.

- Limited government: Positioning the tax as a limited government intervention that allows individuals to make their own choices while still promoting public health and fiscal responsibility.

- Emphasising the urgency of the obesity epidemic: Highlighting the immediate need to address the obesity epidemic and the long-term financial costs of not taking action.

- Using statistics and research to show the negative effects of high sugar intake on health and on the NHS.

- Emphasising the fairness of the tax: Positioning the tax as a fair way to address the problem of obesity and related health issues, which disproportionately affect lower-income individuals and communities.

- Creating jobs: Highlighting how the tax could lead to the creation of new jobs in the public health and wellness sectors.

- Communicating effectively: Using clear, concise language to explain the proposed tax and its potential benefits to the public and government officials, and be prepared to negotiate and address any concerns they may have.

What ideas do you have for overcoming concerns about the potential regressive nature of the tax

- Offsetting the impact on low-income households: Offsetting the impact on low-income households by using the revenue generated from the tax to fund programs that benefit them, such as nutrition education programs and physical activity initiatives.

- Phasing in the tax: Introducing the tax gradually to give households and businesses time to adjust and to monitor its effectiveness.

- Providing tax credits or other forms of financial assistance to low-income households to help them cope with the impact of the tax.

- Using the revenue generated from the tax to fund public health initiatives: using the revenue generated to fund public health initiatives, such as nutrition education programs and physical activity initiatives that specifically target low-income communities.

- Offering alternative options: Offering alternative options such as subsidies for healthy food, can help to mitigate the impact of the tax on low-income households and make healthy food more affordable for them.

- Creating exemptions for certain products: Creating exemptions for certain products, such as basic staple foods, that are important for low-income households and are less likely to contribute to obesity.

- Communicating effectively: Communicating effectively with low-income households and community leaders to explain the tax and its potential benefits, and to address any concerns they may have.

- Evaluating the impact: Regularly evaluating the impact of the tax on low-income households and making adjustments as necessary to mitigate any negative effects.

It’s important to note that some of the above strategies may not be suitable for every situation and it’s important to consider the specific context and the characteristics of the population that would be affected by the tax.

Write a briefing for a meeting to persuade Rishi Sunak to support the tax on Cakes and Confectionaries

Meeting Briefing: Persuading Rishi Sunak, Chancellor of the Exchequer, to Support a Tax on Cakes and Confectionaries

Purpose: To persuade Rishi Sunak, Chancellor of the Exchequer, to support the introduction of a new tax on cakes and confectionaries in order to improve public health and reduce healthcare costs.

Background: The United Kingdom is facing an obesity epidemic, with over two-thirds of adults and one-third of children classified as overweight or obese. The high consumption of sugary foods and drinks is a major contributor to this problem, and there is a growing body of evidence to suggest that implementing a tax on these products could help to reduce consumption and improve public health.

Key Points to Address:

- The potential health and economic benefits of the tax: Highlight the potential health and economic benefits of the tax, such as reducing obesity and healthcare costs, and improving the overall well-being of citizens.

- The phased approach: Suggest introducing the tax gradually to give businesses and consumers time to adjust, and to monitor its effectiveness.

- The use of revenue generated: Propose using the revenue generated from the tax to fund public health initiatives, such as nutrition education programs and physical activity initiatives.

- Addressing concerns about the potential regressive nature of the tax: Offer suggestions for mitigating the impact of the tax on low-income households, such as providing tax credits or other forms of financial assistance.

- International precedents: Point to other countries that have implemented similar taxes and the positive results they have seen in terms of improved public health and reduced healthcare costs.

- Building a coalition: Highlight the broad-based support for the policy from public health organisations, medical professionals, and other stakeholders.

- Communicating effectively: Use clear, concise language to explain the proposed tax and its potential benefits to the public and government officials.

- Be prepared to negotiate: Be open to discussing and modifying the proposal as needed to gain support from key stakeholders and legislators.

- The urgency of the obesity epidemic: Highlighting the immediate need to address the obesity epidemic and the long-term financial costs of not taking action.

- Using statistics and research to show the negative effects of high sugar intake on health and on the NHS.

It’s important to be well-prepared and have a clear message, but also to be open to discuss and negotiate, as the Chancellor may have concerns or questions. It’s also important to understand the Chancellor’s priorities and tailor your message accordingly.

Write an article in the style of Nigella Lawson for the Telegraph supporting the introduction of a tax on cakes and confectionary

“Sweet Treats, Bitter Realities: Why We Need a Tax on Cakes and Confectionary”

As a food writer and lover, I have always had a soft spot for cakes and confectionery. But as someone who is also deeply concerned about public health, I believe it’s time for us to have a serious conversation about the role these sweet treats are playing in our growing obesity epidemic.

The facts are clear: the high consumption of sugary foods and drinks is a major contributor to the problem of obesity in the UK, and there is a growing body of evidence to suggest that implementing a tax on these products could help to reduce consumption and improve public health.

I understand that the idea of taxing cakes and confectionery may be a bitter pill to swallow for some. But the truth is, we need to take bold action to address the obesity epidemic, and a tax on these products is a market-based solution that can help to encourage healthier choices without infringing on personal freedom.

Some may argue that a tax on cakes and confectionery would be unfair to low-income households. But I believe that by using the revenue generated from the tax to fund public health initiatives, such as nutrition education programs and physical activity initiatives, we can offset the impact on these households and make healthy food more affordable for them.

We can also consider a phased approach, introducing the tax gradually to give households and businesses time to adjust and to monitor its effectiveness. We can also create exemptions for certain products, such as basic staple foods that are important for low-income households and are less likely to contribute to obesity.

It’s also important to note that we are not alone in this. Many other countries have implemented similar taxes and have seen positive results in terms of improved public health and reduced healthcare costs.

As a nation, we have a responsibility to take care of ourselves and each other. And while I will always have a special place in my heart for cakes and confectionery, I firmly believe that a tax on these products is a necessary step towards a healthier, happier future for all of us.

It’s time for us to come together and have a serious conversation about the role that cakes and confectionery are playing in our growing obesity epidemic. And I hope that with the support of the government and the public, we can take the necessary steps to address this problem and create a healthier, happier future for all of us.

Write a script for a campaign film supporting the introduction of a tax on cakes and confectionary in the UK

Narrator: “We all love a sweet treat every now and then. But have you ever stopped to think about how much sugar we’re consuming?”

(Opening shot of a child eating a cake, followed by shots of adults eating various sugary foods and drinks)

Narrator: “The truth is, the high consumption of sugary foods and drinks is a major contributor to the obesity epidemic in the UK.”

(Shot of a doctor talking to a patient)

Doctor: “Obesity is a major health concern in the UK, and it’s a problem that’s only getting worse.”

(Shot of a person struggling to climb stairs, followed by shots of people with various health problems)

Narrator: “But what can we do to address this problem? Well, there is a solution that’s been proven to work in other countries.”

(Shot of a news clip of a country introducing a sugar tax)

Narrator: “A tax on sugary foods and drinks. It’s a market-based solution that can help to encourage healthier choices without infringing on personal freedom.”

(Shot of a family shopping in a supermarket, with the price of sugary foods and drinks increasing on the shelves)

Narrator: “And write a script for a 30 second campaign film supporting the introduction of a tax on cakes and confectionary in the UK

Narrator: “We all love a sweet treat, but have you ever stopped to think about how much sugar we’re consuming?”

(Opening shot of a child eating a cake, followed by shots of adults eating various sugary foods and drinks)

Narrator: “The high consumption of sugary foods and drinks is a major contributor to the obesity epidemic in the UK.”

(Shot of a doctor talking to a patient)

Doctor: “Obesity is a major health concern, and it’s a problem that’s only getting worse.”

(Shot of a person struggling to climb stairs, followed by shots of people with various health problems)

Narrator: “But there’s a solution that’s been proven to work. A tax on sugary foods and drinks.”

(Shot of a news clip of a country introducing a sugar tax)

Narrator: “It’s a market-based solution that can encourage healthier choices without infringing on personal freedom.”

(Shot of a family shopping in a supermarket, with the price of sugary foods and drinks increasing on the shelves)

Narrator: “Let’s take action to improve our health. Support a tax on sugary foods and drinks.”

(Closing shot of the word “Support” on a black background)

Make it more positive, don’t use the word obesity

Narrator: “We all love a sweet treat, but have you ever stopped to think about how much sugar we’re consuming?”

(Opening shot of a child eating a cake, followed by shots of adults eating various sugary foods and drinks)

Narrator: “The high consumption of sugary foods and drinks is a major contributor to poor health in the UK.”

(Shot of a doctor talking to a patient)

Doctor: “We all want to live a healthy and happy life, and making small changes in our diet can make a big difference.”

(Shot of a person climbing stairs with ease, followed by shots of people engaging in healthy activities like running and cycling)

Narrator: “But there’s a solution that’s been proven to work. A tax on sugary foods and drinks.”

(Shot of a news clip of a country introducing a sugar tax)

Narrator: “It’s a market-based solution that can encourage healthier choices without infringing on personal freedom.”

(Shot of a family shopping in a supermarket, with the price of sugary foods and drinks increasing on the shelves)

Narrator: “Let’s take action to improve our health. Support a tax on sugary foods and drinks.”

(Closing shot of the word “Support” on a green background, with a healthy food in the foreground)

Don’t use images of people eating unhealthy foods

Narrator: “We all love a sweet treat, but have you ever stopped to think about how much sugar we’re consuming?”

(Opening shot of a child playing with a cake, followed by shots of healthy foods like fruits and vegetables)

Narrator: “The high consumption of sugary foods and drinks is a major contributor to poor health in the UK.”

(Shot of a doctor talking to a patient)

Doctor: “We all want to live a healthy and happy life, and making small changes in our diet can make a big difference.”

(Shot of a person climbing stairs with ease, followed by shots of people engaging in healthy activities like running and cycling)

Narrator: “But there’s a solution that’s been proven to work. A tax on sugary foods and drinks.”

(Shot of a news clip of a country introducing a sugar tax)

Narrator: “It’s a market-based solution that can encourage healthier choices without infringing on personal freedom.”

(Shot of a family shopping in a supermarket, with the price of sugary foods and drinks increasing on the shelves)

Narrator: “Let’s take action to improve our health. Support a tax on sugary foods and drinks.”

(Closing shot of the word “Support” on a green background, with a healthy food in the foreground)